Plus applicable surcharge and cess. ₹1 lakh exemption available for capital gains. Source: www.sbi.co.in, www.indiapost.gov.in, as on Date 1-Nov-2018.

| Investment Options under Sec 80C | Minimum Investment (in ₹) | Lock-in years | Returns (in %) | Tax Treatment |

|---|---|---|---|---|

| Public Provident Fund (PPF) | 500 | 15 | 8% | Interest tax free |

| National Saving Certificate (NSC) | 100 | 5 | 8% | Interest income taxable |

| Bank FD | 1000 | 5 | 6.85% | Interest income taxable |

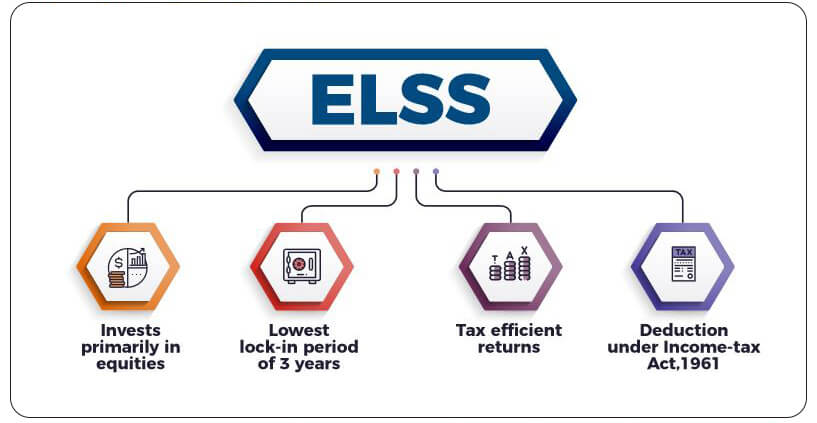

| Equity- Linked Saving Scheme (ELSS) | 500 | 3 | Market Linked | Dividend and capital gains taxed at 10%^ |