Financial Education Workshops

‘India is a nation of Savers but not Investors” and the primary cause for this problem is the lack of Financial knowledge.

Vast majority of the household money in India is lying in Bank deposits, Post Office schemes or low yielding insurance policies, earning a paltry return after factoring tax and inflation.

Equity is the only asset class which helps in beating inflation and generating wealth over a long period of time. World over smart people buy pure Term insurance to protect themselves against any risk but in India most people end up buying insurance cum investment plans, pay huge premiums yet remain underinsured.

This clearly shows that ‘India is a nation of Savers but not Investors” and the primary cause for this problem is the lack of Financial knowledge. Financial literacy is the education and understanding of various financial areas including topics related to managing personal finance, money and investing.

Get Started

Need For Financial Education

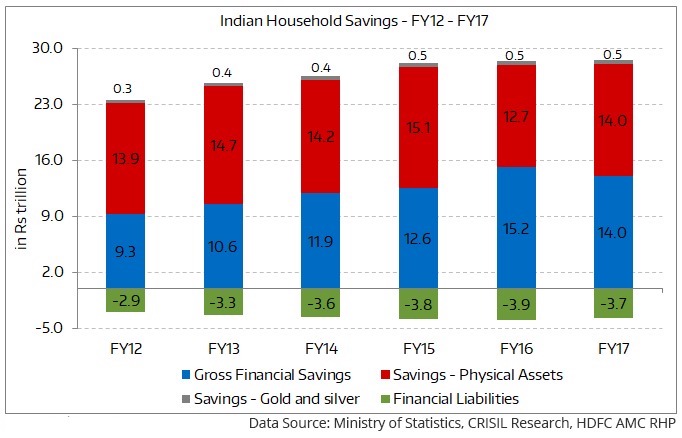

Financial education has assumed greater importance in the recent years, as there is a structural shift in financialization of savings from physical assets such as real estate and gold to financial assets. Financial savings has grown much faster compared to growth in other assets, as a part of the overall savings of Indian households. Moreover, financial markets have become increasingly complex and there are multiple investment products and solutions challenging for a layman to understand.

India Is Moving Towards Financialization of Household Savings

Financial Education Workshops

We organise workshops for employees of:

- Large Corporates,

- Small & Medium Enterprises,

- Trade bodies,

- Professional bodies,

- Housing societies,

- NGOs,

- Business Schools

The workshops are well structured and are conducted by experienced professionals.

The workshops can be organized for a group of 20-50 participants.

The participants will be educated on wide variety of Financial Topics in a very simple language which they can understand and relate to.

Participants gain a basic understanding about topics such as :

- Investment Options

- Financial Planning and its components i.e.

- Insurance Planning

- Investment Planning

- Tax Planning

- Retirement Planning