Key Takeaways

- Compounding is an incredibly powerful tool and works like magic over the long term.

- Key to allow the magic of compounding work for you is “To start investing early in life and invest regularly over a long period of time.”

- Start Investing as Soon you Start Earning.

- Be disciplined, Stay the Course keeping your Financial Goals in Mind.

- Don’t let short-term market volatility hinder your investing discipline.

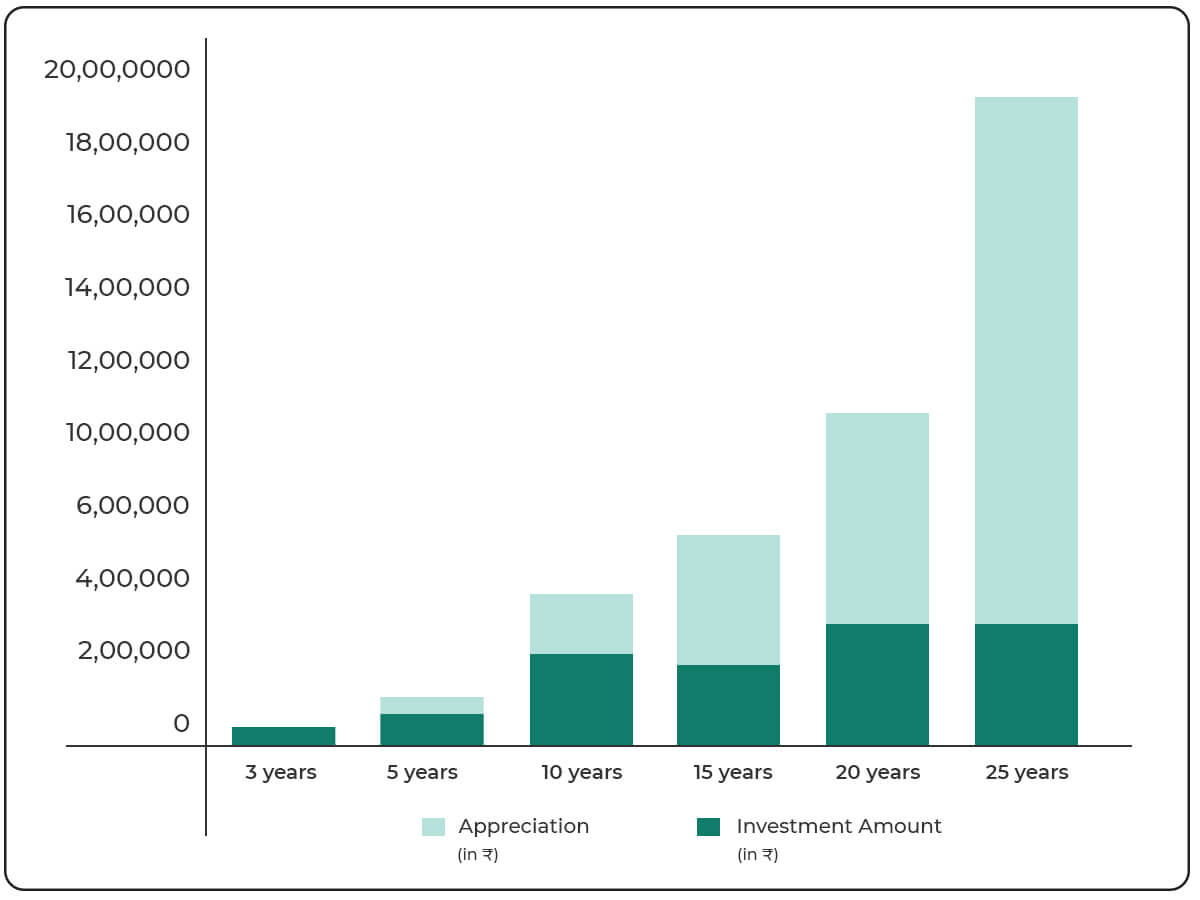

Let’s see how much money can be accumulated through an SIP investment of ₹1000/month.

| Tenure (in years) | Investment Amount (in ₹) | Appreciation (in ₹) | Market Value (in ₹) |

|---|---|---|---|

| 3 | 36,000 | 7,508 | 43,508 |

| 5 | 60000, | 22,487 | 82,487 |

| 10 | 1,20,000 | 1,12,340 | 2,32,340 |

| 15 | 1,80,000 | 3,24,576 | 5,04,576 |

| 20 | 2,40,000 | 7,59,148 | 9,99,148 |

| 25 | 3,00,000 | 1,59,7636 | 18,97,636 |

Assuming an SIP amount of ₹1000 growing as 12% CAGR. This is just an Illustration with assumed rates to explain the power of compounding.

- It is evident from the graph that as the number of years increase, the money compounds at a much higher rate.

- Even though the original Investment is very low, the capital appreciation is much higher.

This is the Power of Compounding.